Good afternoon, and Happy Thanksgiving! At its heart, Thanksgiving celebrates a full harvest — abundance of the land. It’s a great reminder that abundance is not nature’s default. It’s something we have to actively build toward.

This year, we at Per Aspera are grateful for all of you — for being part of this community; for working on hard, important things; for expanding further into the cosmos; for harnessing more of our solar system’s energy; and, most importantly, for believing that the future is something we must build, not something that happens to us.

This mindset is why you are reading a newsletter about industrial strategy and geothermal physics late on a Tuesday, while most normies have already mentally checked out for football and turkey. You are simply built different.

IN THIS WEEK’S EDITION:

🌪️ The Commission that cried wolf (and was right)

🌋 How to poke a hole in an Oregon volcano

🧬 Genesis Mission, generalist AI, and more…

Forwarded this email? Subscribe to Per Aspera here.

The Commission That Cried Wolf (And Was Right)

For 25 years, the U.S.-China Economic and Security Review Commission (USCC) has been Washington’s designated China hawk, and its most ignored oracle. Founded in 2000 as a consolation prize for skeptics of China’s WTO accession, the Commission spent two decades producing rigorous, alarming reports on the CCP’s industrial ambitions that gathered dust while the establishment preached engagement. In an era of “End of History” triumphalism, USCC was like a skunk at the garden party.

Times have changed. As bipartisan consensus on China hardened, the Commission has moved from the advisory margins toward the center of economic statecraft. And its latest annual report to Congress, released last week, does something rare for a government document: it admits total strategic failure. The Commissioners write that (A) America’s patchwork statecraft failed to arrest China’s technological rise, and (B) Beijing successfully built “interlocking innovation flywheels” that market mechanisms alone cannot counter or contain.

Two Shocks, Two Logics

China Shock 1.0 (c. 2001): The post-WTO flood of labor-intensive goods (textiles, furniture, toys) hollowed out factory towns but subsidized American consumers. The tradeoff was politically legible: concentrated pain, diffuse gain. We could tell ourselves this was comparative advantage working as designed.

China Shock 2.0 (now): A state-directed flood of capital-intensive capabilities. Beijing deploys massive overcapacity to drown global markets with underpriced solar panels, EV batteries, rare-earth magnets, and critical electronics. The logic isn’t profit maximization, but industrial commons capture. Win one strategic sector (EVs), and you may inherit adjacencies up and down the stack (batteries, sensors, autonomy).

The Commission’s verdict on Made in China 2025, now in its final year, is that the PRC now possesses a “hyper-charged, state-directed manufacturing base without historic parallel,” that is systematically deindustrializing the West.

The Prescription: From Compliance to Command

The Commission tells its Congressional handlers that incrementalism has failed, and proposes a radical restructuring of the federal government:

An Economic CIA: Washington's authority over export controls, sanctions, and investment screening is fragmented across Commerce, Treasury, State, and the Pentagon, a bureaucratic archipelago that’s no match for Beijing's lockstep integration. The proposed fix is a "consolidated economic statecraft entity": a superagency, of sorts, with hard enforcement powers and, crucially, integration into the Intelligence Community.

You’ll Own Nothing (And Be Happy?) Rather than selling silicon that disappears into adversary supply chains, the Commission proposes a licensing model that would make chips above a certain computing threshold accessible exclusively via the cloud. This would keep hardware under American/Allied jurisdiction while (in theory) preserving revenue streams, and in effect would grant Washington a “kill switch” to cut off inference if a user is detected doing something off limits (e.g., training military models or violating KYC). Whether sovereign buyers would accept such dependency is unclear, but the concept inverts the current paradigm.

Over-the-horizon technologies: The Commission identifies two general-purpose technologies where it sees American strategy drifting.

On quantum, it urges a “Quantum First by 2030" national goal to secure computational advantage in cryptography, drug discovery, and materials science, before adversaries break current encryption standards.

On biology, it reframes the sector from healthcare to an industrial platform that could produce up to 60% of the global economy’s physical goods by mid-century, and calls for the buildout of a national bioeconomy industrial base.

Hamilton Gets the Last Laugh

For ~40 years, “industrial policy” was a dirty word in Washington. The reigning orthodoxy held that markets were neutral arenas where the most efficient allocator wins. We wanted the home team to win but fashioned ourselves more as a passive referee vs. an active fighter in the ring. But the 21st century has made all too clear: the invisible hand cannot parry a state-directed fist. Strip away partisan coding and past transgressions and you’ll see it across U.S. power centers: what’s emerging now, across Wall Street, Silicon Valley, and both parties in Congress, is a return to the factory settings of the American Republic. The new consensus holds that political independence is downstream of industrial capacity. But this is not a new idea. A Founding Father wrote it down 233 years ago!

Not only the wealth, but the independence and security of a Country, appear to be materially connected with the prosperity of manufactures. Every nation, with a view to those great objects, ought to endeavor to possess within itself all the essentials of national supply.

Updated for the present: if you can't build your own ships, forge your own chips, or synthesize your own drugs, you are a client state with a large credit card limit.

Washington is beginning to metabolize this. But restacking the American hierarchy of needs, from an economy optimized for convenience, consumer surplus, and capital efficiency to one built for strategic autonomy, is economically and politically painful. Sovereignty is inflationary. Forgetting or losing it has a price: we pay premiums for ore mined in Nevada, chips fabbed in Arizona, or AP1000s made in Georgia. But technology is deflationary, and hope springs eternal: we’re optimistic that a properly focused, motivated, and unleashed American industry can crush learning curves in due course. For its part, the Commission’s message is clear: it’s time to shift from a defensive crouch (fragmented, reactive, compliance-focused policy) into an offensive footing of economic statecraft.

In Search of Supercriticality

Two years ago, Mazama Energy inherited a dormant dream: 17 years of failed attempts to crack the Newberry Volcano, abandoned wells, and mounting skepticism about whether superhot rock geothermal could ever work. This October, they drilled two miles into the flank of the Oregon complex and hit 629°F, earning a new global record. Now comes the hard part.

The dream: Geothermal has long been the tantalizing also-ran of clean energy: baseload power, no intermittency, minimal land footprint, heat that never runs out. And yet it supplies <0.5% of U.S. electricity. Lackluster adoption comes down to geology and drilling economics: most of Earth’s heat is simply locked too deep to access profitably.

The physics: At 750°F, water enters a supercritical state: it flows like gas but carries heat like liquid, yielding 5-10× the power output of a conventional geothermal well. The supercritical regime (much higher power output per borehole) is what Mazama, backed by Khosla Ventures, Gates Frontier, and DOE, is after.

A geologist’s arb: Newberry’s value is its thermal gradient. Most crustal rock requires drilling 12+ miles deep to reach supercritical temperatures; here, you can hit 750° at under three.

Hardcore thermal management: To withstand downhole conditions that would cook standard oilfield electronics, Mazama cools its drill strings with liquid CO₂ that protects its sensor packages during their 2-mile dive through granite, basalt, and granodiorite. In October’s test, the team hit 100+ ft/hr penetration rates with zero downhole failures.

Now for the part frontier tech founders know all too well…

Mazama has proven the basic technique. Now they have to productionize it. A 15 MW pilot is planned for next year; Newberry has a theoretical capacity of ~5 GW, enough to supply two-thirds of Oregon’s electricity from a single geological feature. But bridging the gap between “theoretical capacity” and “commercially viable power” means answering more hard questions around unit economics across dozens of wells, the technology’s reliability, reservoir consistency, and so on.

Seventeen years of false starts at Newberry suggest humility. But Mazama’s October campaign delivered something the previous attempts didn't: working hardware at temperature. That’s real, as is the bid from hyperscale datacenters scouring the West for a stable supply of scalable, clean power.

Speaking of structural strategic shifts: alongside an Apple-style announcement, President Trump signed an Executive Order launching the Genesis Mission — a whole-of-government push led by the Department of Energy and its 17 National Laboratories to build the world’s most powerful scientific platform.

Genesis announcement video under Joe Gebbia — Airbnb cofounder and the White House’s first Chief Design Officer (genesis.energy.gov)

Under Genesis, DOE is charged with building the American Science and Security Platform, a unified tech stack that connects national lab supercomputers, secure AI cloud environments, domain-specific foundation models, large federal datasets, and autonomous “closed-loop” experimentation systems such as robotic labs. And the clock starts now: within 60 days, DOE must prioritize the most critical scientific and technological challenges. By the 270-day mark, they must stand up and demonstrate initial operational capability of the platform.

Most members of the Per Aspera community know this bottleneck firsthand: the U.S. has world-class scientific infrastructure, yet these assets usually operate as disconnected silos. Genesis aims to treat them as a true national platform, turning idle compute and isolated datasets into real scientific outputs.

Physical Intelligence — building a general-purpose foundation model for robots — just raised $600M at a $5.6B valuation, led by Alphabet’s CapitalG with Jeff Bezos, Thrive, Lux, Index, and T. Rowe Price in the stack. As we wrote in The Last Hardware Problem, robotics has been trapped in: brittle, one-robot-one-task systems; a crippling lack of real-world egocentric data; and models that collapse under a long tail of edge cases. Physical Intelligence is one of the first companies directly attacking those constraints through:

A generalist control model that learns manipulation skills and works across many robots.

Small robot datasets amplified by internet-scale vision-language pretraining, giving the model broad world understanding.

That combination unlocks real-world generalization, enabling long-horizon tasks in unfamiliar homes.

This could break a fundamental bottleneck holding the field back. If a skill learned on one robot can immediately work on another, or in a new home the system has never seen, then robotics finally starts to behave like software instead of an endless series of bespoke machines. It can be a path out of the demo loop and toward something we’ve never had: a scalable, generalizable intelligence layer for the physical world.

If you’ve been with Per Aspera since the get-go, you’ll remember that one of the places we started was with Gilman Louie — who in his 2022 Senate testimony, detailed how the U.S. spent three decades starving hardware of capital.

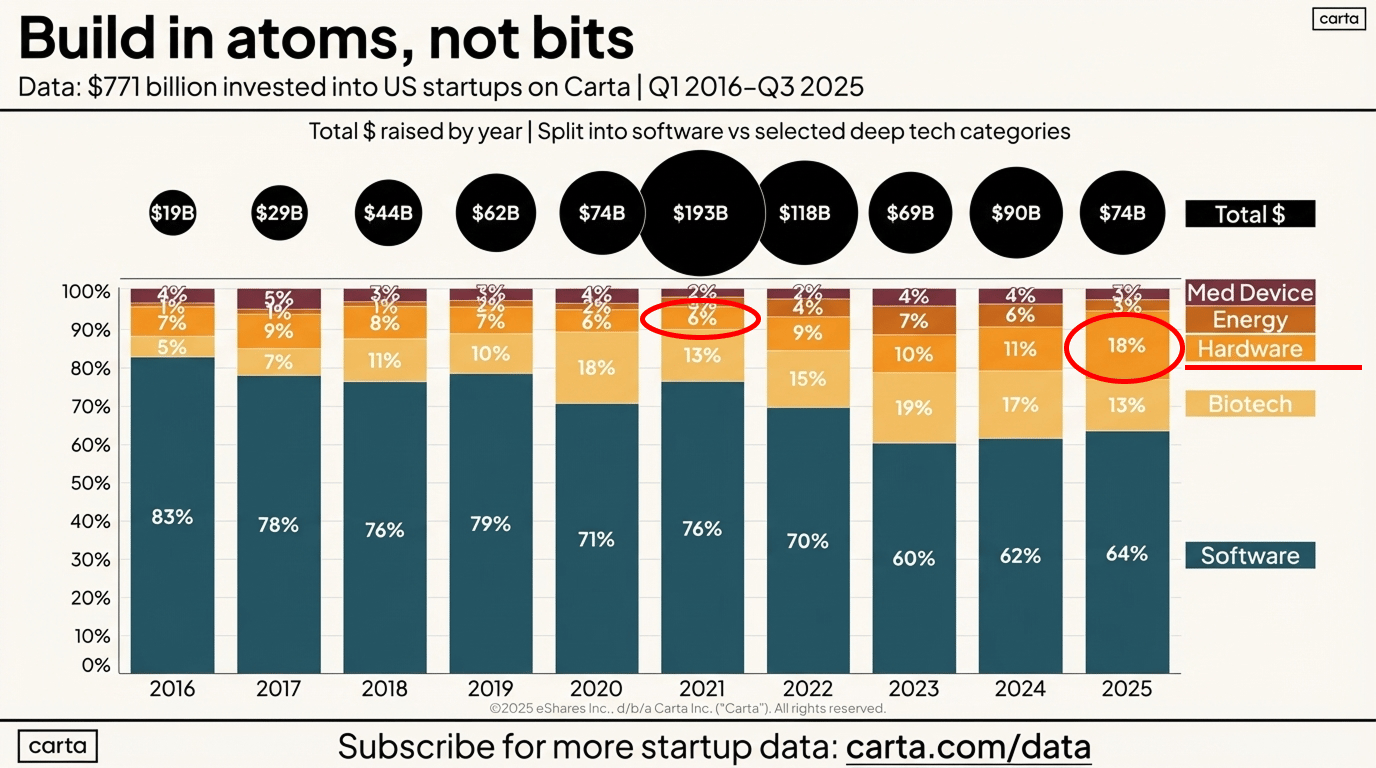

In 2021, U.S. venture capital investment in hardware startups was just $9 billion. By comparison, nearly 14 times the investment went to software, or $124 billion. Chinese venture investment in microelectronics tripled from 2019 to 2020. And last year, microelectronics startups in China received six times the amount invested in comparable U.S. firms.

Yesterday, Peter Walker — Carta’s Head of Insights and something of an investment charts celebrity — released new data that shows the tide turning.

The era of ignoring atoms is over. Hardware’s share of venture funding has jumped from 6% in 2021 to 18% this year, a tripling that signals the capital markets are finally starting to match rhetoric. As we celebrate the return of interest in the physical world, it’s worth recalling a line from Palantir’s Shyam Sankar at this year’s Reindustrialize:

“Bits can’t replace atoms — but you can bend atoms better with bits.”

If you’ve been reading the last few issues of Per Aspera, then you’ll know: there’s a lot to be optimistic about on this front!

Per Aspera Friends in High, Hard Places

An homage to the OG DARPA Grand Challenge…

DARPA Lift Challenge. DARPA has issued a new challenge: for El Segundo founders to deadlift eight plates without posting about it. (We kid…) The DARPA Lift Challenge, announced Nov. 13, offers $6.5M in prize money to whoever can develop a multirotor drone with a 4:1 payload-to-weight ratio. The military's mad-science research wing theorizes that recent advances in aerodynamic design, materials science, and propulsion make such a ratio possible. To compete, designs must weigh in under 55 lbs, including fuel/power, and be capable of carrying a minimum payload of 110 lbs across a 5-mile circuit course.

Any of y’all up for the challenge? More info here.

Where’s the money in satellite DTC? Not necessarily where you’d expect. Our friends at Mach33, a space investment and research group, built a 5,000-run Monte Carlo model to size the direct-to-cell (DTC) satellite opportunity. The model pegs the global TAM at ~$37B by 2030, and the country-level outputs are somewhat counterintuitive, with Nigeria ($2.8B) outranking the U.S. ($2.4B). Meanwhile, despite having 1.5B people, India clocks in at ~$800M.

What gives? The variable that matters most is not population or income, per Mach33, but dropout prevalence: how often users fall out of terrestrial coverage. This has notable strategic implications — namely, that the real national markets aren’t necessarily low-income (low ARPU) or wealthy (good terrestrial telco coverage), but in between: upper-middle-income countries where 100Ms of subs are paying for service they can’t reliably use. This is where dropout rates are high enough to create demand, and ARPU is high enough to justify the economics.

Go deeper: You can check out the model here, if you’re so inclined.

Trusted Tech Summit 2025. Our friends at the Krach Institute for Tech Diplomacy at Purdue — led by CEO Michelle Giuda (↑) — convened their 4th annual summit, where they launched the Global Trusted Tech Network, a free-world alliance designed to keep technology aligned with freedom. As part of the Summit, they recognized the 2025 Trusted Tech Leadership Award honorees: Atomic Industries, ReElement Technologies, Strider Technologies, and the Government of Sweden. (P.S. Your very own Dan Goldin serves on the KITDP Advisory Council!)