Good morning — it’s your Editor, Ryan Duffy. Today is Veterans Day, and I wanted to recognize something remarkable about this community. Something I’m deeply proud of:

A disproportionate share of Per Aspera readers — you all — are veterans or active service members.

Many of you are now building the companies that strengthen our industrial base, launching funds that back American builders, shaping defense and technology policy, even leading missions in orbit — all in pursuit of our collective future and our nation’s leadership.

Thank you for your service, both past and continued, and for reminding us that mission never really ends.

With that, I’ll hand it off to Dan Goldin, who spoke last week at The Economist Space Summit about why space needs to evolve into an Earth return business.

IN THIS WEEK’S EDITION:

🔭 The case for more Earth return businesses

🏅 The supercycle’s second-order winners

🌊 Something’s in the (Gundo) water

🫧 AI build, bub talk, backstopgate

Forwarded this? Subscribe for more.

WHERE ARE MY ASTEROID MINES?

Last week, standing not too far from Kennedy Space Center, I told a crowd of space leaders something that’s been weighing on me: I’m bored by the space program. By that, I mean I’m bored with low Earth orbit.

Thirty years ago, I walked into my new NASA job and declared that we had to darken the skies with small affordable satellites, commoditize launch, and get the government out of Earth orbit. The agency and the private sector succeeded in doing this, but then, we stopped.

SpaceX solved cheap launch, and still, the entire commercial space economy is largely one thing: communications (along with some imagery and positioning services). We keep launching more satellites, with better bandwidth and the same business model. A “single note band,” as I call it. We have the physics figured out. We have the technology. We have the capital. Yet somehow, in 2025, there’s virtually no manufacturing happening in space. No asteroid mining. No wealth being extracted from the solar system and brought back to Earth.

We haven’t seen doodly squat from space!

The question nobody’s asking is simple, but it’s an important one. What do we want to do in space?

Consider the platinum group metals: platinum, palladium, rhodium, iridium, osmium, ruthenium. A $40B+ annual market at ~$50,000/kilogram, the PGMs mostly come from one place: South Africa, which controls ~75% of global reserves.

There are obvious problems here: depths often exceed 3,000 meters, operations are 60% loss-making, and the number of operational shafts has collapsed from 81 to 53 in the last two decades. Plus, it’s a geopolitical vulnerability dressed up as a mining operation.

Now, consider near-Earth asteroids. When the solar system formed, heavy metals sank to planetary cores. On Earth, platinum lies thousands of feet down. But asteroids are unformed planets — same composition, with PGMs accessible at the surface.

It requires less energy to reach some of these asteroids than the Moon. With missions like OSIRIS-REx and Hayabusa2, we have proved that the technical concept works.

Commercial asteroid mining is viable. Hard? Sure. Full of challenges? You bet. But we can do it.

The ISS legacy, and the manufacturing opportunity ahead of us

The ISS has operated flawlessly, despite Americans and Russians sharing a tin can in space for a quarter-century while their militaries were pointing weapons at each other. And the ISS has shown us something fundamental: that the absence of gravity enables manufacturing that’s physically impossible on Earth.

We’ve spent 25 years proving that microgravity eliminates the physics constraints that plague terrestrial production. No sedimentation, no convection, no buoyancy-driven separation…just perfect crystallization.

We’ve run hundreds semiconductor experiments, and produced six-inch sub-2nm gallium arsenide wafers with crystalline perfection impossible on Earth, enabling defense applications previously thought theoretical.

ZBLAN optical fiber manufactured in space transmits 10-100× better than terrestrial silica (and it would sell at a significant premium).

Merck crystallized Keytruda in space. Varda has flown three missions returning pharmaceutical crystals to Earth, with mission costs dropping from $12M to a projected $2.5M through capsule reuse.

Spaceplanes offers an alternative: gentle Earth return with negligible G-forces, enabling a quieter microgravity laboratory.

The physics work, and the economics can pencil. And that’s why I think that the ISS needs to come down soon — not because it failed, but because it succeeded so completely that we’ve become complacent. We use it as an excuse to avoid building the distributed commercial platforms that should replace it. We’ve grown dependent on a government lab rather than investing in an Earth-returning economy.

Reaching, not Incrementing

I’d like to congratulate my successor, Jared Isaacman, on his renomination as NASA Administrator. Jared gets what needs to happen. Commercial operators need to take over LEO. NASA needs to facilitate that transition, then go beyond it.

To this, I add: it’s time to diversify beyond a services-based LEO economy! We need serious commercial efforts to make and return products from space.

The infrastructure is already coming together. More capsules are returning to Earth. And the downmass bottleneck (9-12 metric tons annually with Dragon) will ease as reentry technologies proliferate.

Here's what I believe needs to happen: An eight-year sprint from 2025 to 2033.

Not 15 years of planning or 20 years of incremental progress. Eight years.

Why do I know that eight years can work?

In 1955, Eisenhower asked for an ICBM in eight years. We delivered Delta, Atlas, Titan, and Minuteman.

In 1961, JFK asked for the Moon in eight years. We landed and returned safely.

Both efforts produced cascading technologies (e.g. semiconductors), materials, and manufacturing processes that became foundational to the American economy.

America does best when it reaches, not increments. We need to reach again. Out of Earth orbit. Towards asteroids. Towards manufacturing. Towards a space-faring future and Earth-returning economy.

THE SUPERCYCLE’S SECOND-ORDER WINNERS

The AI supercycle is minting unexpected winners in the strangest corners of the industrial world — not NVIDIA or OpenAI, but the people, companies, and industries you wouldn’t readily think of as dynamic cogs keeping the AI supercycle narrative spinning. We’ve seen so many that we’re launching this new recurring section in the newsletter. Without further ado, the two nominees this week:

001 / The Aircraft Boneyard Raiders

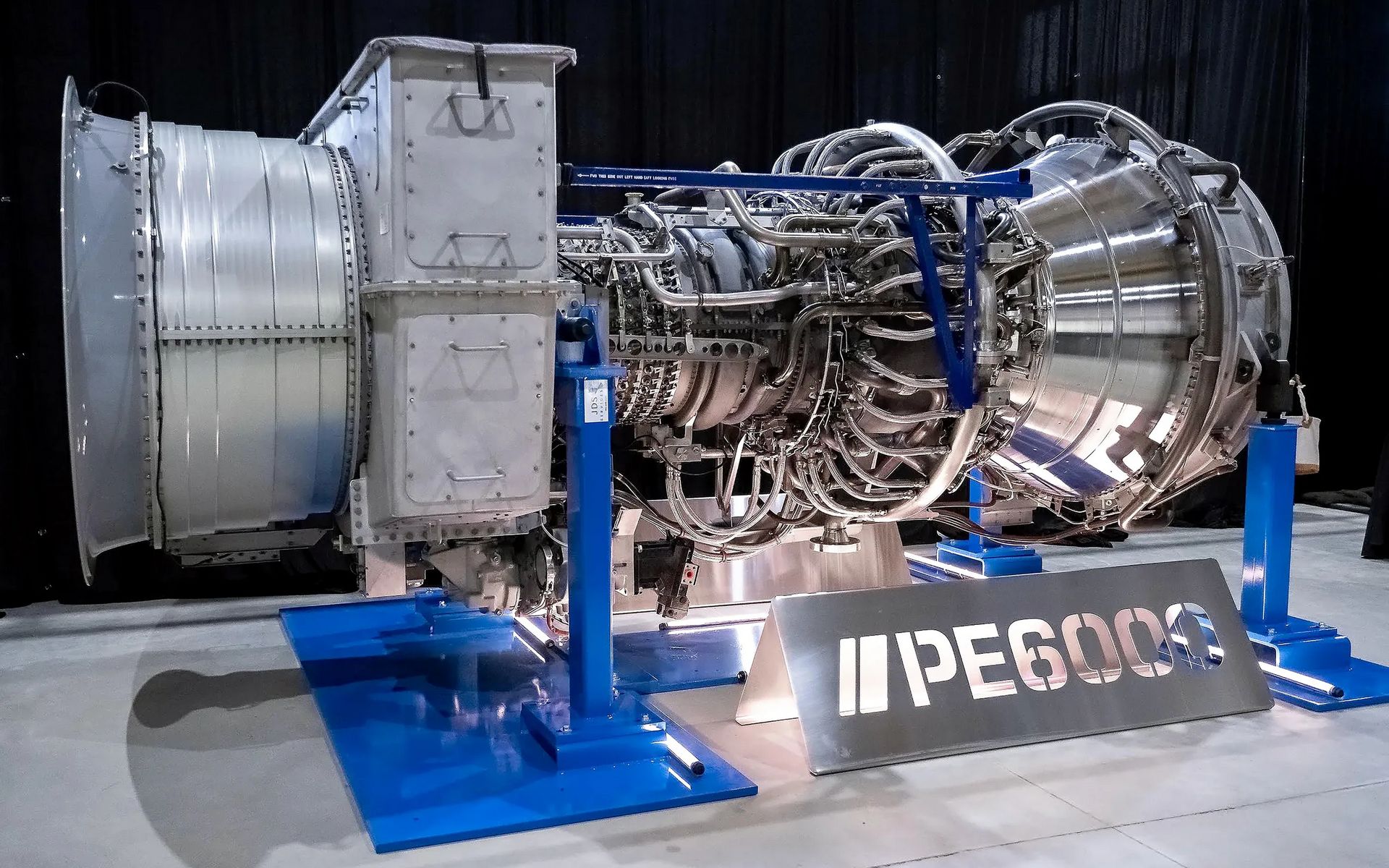

ProEnergy, a turbine services company in Sedalia, Missouri, saw an arbitrage that everyone else missed (or, thought was impossible).

The obvious problem: hyperscalers need gigawatts now. New gas turbines from GE, Siemens, and Mitsubishi have lead times stretching to 2029 and beyond, with some hyperscalers paying $25M just to get in line. All the while, grid interconnections are hitting eight to ten years in some regions.

An unlikely solution: airlines are retiring CF6-80C2 jet engines (the legendary high-bypass turbofans that powered Boeing 767s, 747s, and Airbus A310s across oceans for three decades) as they modernize widebody fleets.

ProEnergy spent seven years and $115M developing a process to fully overhaul these CF6-80C2 engine cores, matching them with new aeroderivative components, mounting them onto trailers with integrated switchgear, and delivering 48MW units that can be stood up in 30 days. The company has sold 21 units (1+ GW total) to Texas datacenters that will run 24/7 for the next 5-7 years while awaiting grid connections. Since 2020, ProEnergy has fabricated 75 PE6000 packages, with another 52 in assembly or on order.

The timing is brilliant. Airlines will retire ~1,000 of these engines this decade, each one a latent power asset waiting for exactly this kind of creative repurposing.

002 / The Yellow Bulldozer Company

Caterpillar is a century-old company that’s synonymous with its yellow bulldozers. But going off sales, it’s more of a power company than it is a bulldozer company. Wall Street and the rest of us are only now catching on.

The flippening: Last year, for the first time in company history, Caterpillar’s Energy & Transportation (E&T) segment (turbines, diesel generators, gas engines, marine power systems) out-earned its Construction Equipment unit ($28.9B to $25.5B). And last quarter, power generation sales jumped 31% while construction grew just 7%. E&T’s $8.4B in Q3 sales blew out analyst expectations by $1B+ and helped send $CAT to all-time highs.

What’s driving this? Hyperscale datacenter (DC) campuses often call for 50+ diesel generator sets per facility at ~$2M a pop, all synchronized and running around the clock. While DCs bought these as emergency insurance, they’re now procuring them as primary power.

Caterpillar, as the #2 vendor of these generators globally, was all too happy to oblige when the hyperscalers came knocking. And it goes beyond diesel gensets: Caterpillar will sell you a complete microgrid with integrated battery storage, renewable capacity, and fuel flexibility. (One recent deal, a Utah DC campus, included 4GW of generation capacity with 1.1GWh of battery storage).

Prime power is the new prime real estate: On Caterpillar's Q3 victory lap earnings call, CEO Joe Creed was clear about the opportunity: "We're definitely really excited about the prime power opportunity with data centers. We're going to see a lot more of this." The best part for Caterpillar: the $2M equipment sale comes with attached services contracts and decade-long relationships for monitoring, maintenance, optimization, and fuel logistics. Caterpillar’s $40B backlog includes bilions in new DC power orders, positioning the company and its supply chain for years of guaranteed work.

Something’s in the Water in El Segundo

Yesterday, within a few hours, two El Segundo-based companies announced two large funding rounds: Valar Atomics closed a $130M Series A (total raised: $150M+), while Neros raised a $75M Series B (total raised: $121M).

Valar is breaking ground on its first test reactor in Utah, targeting 100 kilowatts by July 4 and gigawatt-scale generation by decade’s end.

Neros, led by two former professional FPV drone racers, has shipped thousands of its units to Ukraine and the U.S. Army. It’s targeting a 1M yearly production rate, using an American/Allied supply chain, which is no small thing.

A couple years back, this new generation of “Gundo” founders was lighting up social media timelines, talking a big game and getting dunked on by online critics. They then collectively disappeared for a while, presumably having gone heads-down on company-building. Now, they’re emerging on the other side with functioning hardware programs, real customer traction, teams that can execute, and orders of magnitude more capital.

‘Grats to the Gundo — here’s hoping that this wave of founders inspires more bright, young, ambitious engineers and restless tinkerers to join a deep tech startup or even start one themselves!

The AI Build, Bub Talk, & Backstopgate

There are two “B words” in AI you don’t want to say out loud if you’re a hyperscaler or underwriter of the capex buildout: bubble, or backstop. Last week, OpenAI’s CFO suggested the government should “backstop” infrastructure loans for the company’s $1.4T buildout. To which Trump’s AI czar David Sacks said: “there will be no federal bailout for AI,” adding another b-word to our lexicon. OpenAI walked back the comments and quickly clarified that it “does not have or want federal guarantees” for datacenters, but the damage was done.

Backstopgate fed into fears over all of this spending, as analysts and newsletter pundits question whether it will all pencil out. (Related: Deutsche Bank is exploring strategies to hedge AI exposure, after lending billions to datacenter developers.) The investor indigestion is for good reason. Hyperscalers spent $112B on capex in the last three months, now burning ~60% of operating cash flow (the highest ratio ever). Yet, at the same time, the colossal AI build is still seriously supply-constrained, with AI accelerators fully allocated through 2026, memory chips sold out through ‘27, and some upstream power parts back-ordered half a decade.

So…which is it? Shall we call it Schrödinger’s Supercycle?

A Per Aspera & Friends Special

Last Wednesday, we co-hosted an intimate, exclusive dinner in Orlando with space investors Mach 33 (led by Aaron Burnett, you might remember him from our joint Antimemo) and space-dedicated design firm Out of This World Design (led by Jose Arcos, also Per Aspera Official Sponsor 🇺🇸💥).

What began as an X post by Aaron 👇:

Turned into our dinner theme “Next Five Years” 👇:

A dinner bringing together some of the peak talents who are working to make sure that the next five years in commercial space are going to be wild.

Shout out to those who showed up: from founders/leaders of Stoke Space, Array Labs, AstroForge, to investment bankers and VCs, to NASA leaders, past and present, who have made history before and are now working with commercial teams to do it again.

And to all of you, from the Mach33 x OOTWD x Per Aspera crews — here’s to a wild next five years of American leadership in space. 🥂🇺🇸🌌

👋 Out of This World Design x Mach33 x Per Aspera crews

Extra Renaissance Rumblings

YASA set a new unofficial power density record for electric motors: 750 kW and 59 kW/kg with a 12.7kg axial flux prototype (pictured above) // Engineers test photonic chips in space // China offers BOGO deal to its hyperscalers: use indigenous AI accelerators, get half off your datacenter power bills // Phoenix Tailings opens domestic rare earth facility with 0% reliance on Chinese inputs, equipment, or technology // AWS is developing Fastnet, a subsea cable with robust armoring and 320 Tbps capacity…and will bury it “as deeply as possible” so that near-peer adversaries sharks cannot sever the cable // Also under the sea, China has reportedly completed the first phase of its $226M UDC (underwater datacenter) project // Tom Brady, the winningest QB of all time (go Pats), revealed that his dog Junie is a clone of Lua, his late pit bull mix.